- calendar_month September 24, 2024

- folder Buyers

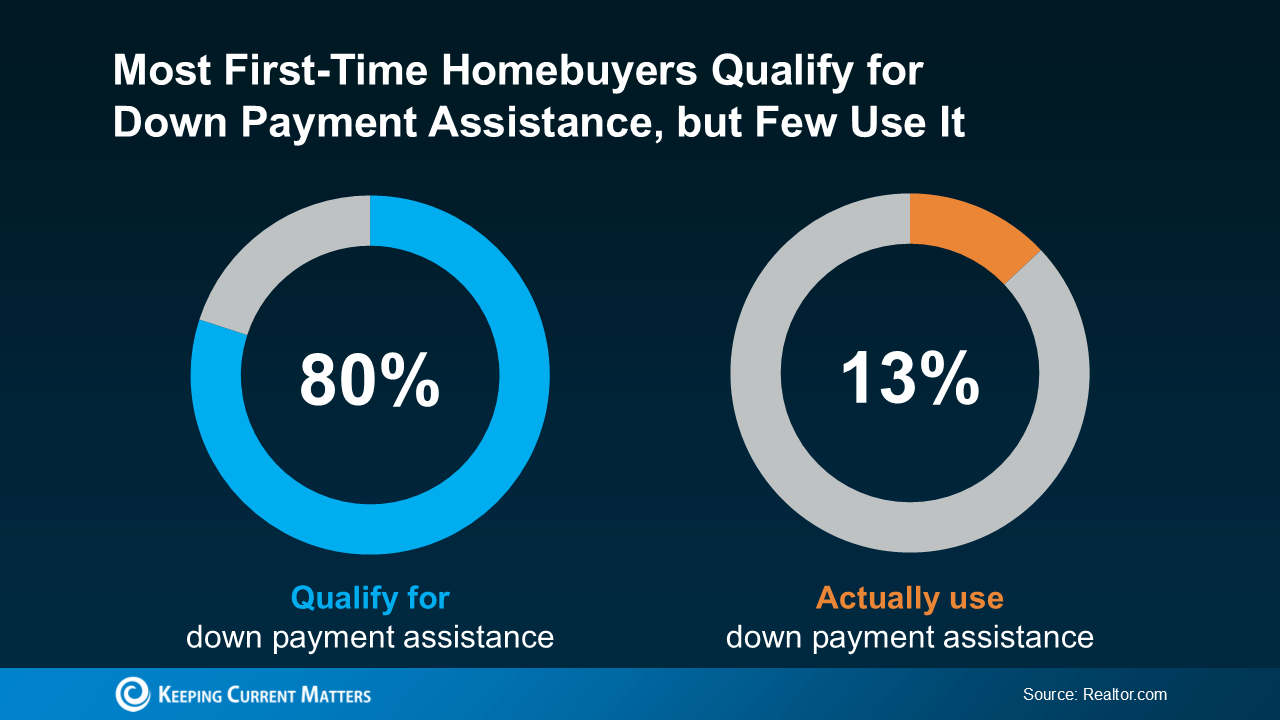

As two Realtors who understand the importance of home ownership, we’re excited to share some valuable news that could change the game for first-time buyers like you! Did you know that almost 80% of first-time home buyers actually qualify for down payment assistance, but only 13% take advantage of it? We’re here to help bridge that gap and show you how to make the most of these resources (see graph below):

Maximizing Your Down Payment Potential When it comes to purchasing your first home, the key is knowing what resources are available to you. Many loan programs offer options with as little as 3% down, or even 0% for qualified buyers such as veterans. Plus, there are grants and other assistance programs designed to help cover your down payment. It’s like having a helping hand on this exciting journey.

By connecting with a trusted lender, you can explore all the options that are available to you. It’s important to remember that every dollar counts, and these resources can significantly boost your down payment. The best part? A higher down payment can lead to lower monthly mortgage payments and possibly even reduce those extra fees like private mortgage insurance (PMI).

Don’t Let Headlines About Rising Down Payments Worry You We understand that recent news may have caught your attention, reporting that the typical down payment is increasing. But don’t worry—down payment requirements aren’t rising! The reason for higher averages is because some buyers are choosing to put more down to offset higher mortgage rates, or they’re tapping into the equity from their previous homes.

Let’s break it down for you:

- A bigger down payment means a lower monthly mortgage. Some buyers who can afford to do so are choosing this route to help with affordability.

- Homeowners are using equity. If someone already owns a home, they likely have built up equity over time. That extra value allows them to put more down on their next home.

The Bottom Line At the end of the day, the best thing you can do is talk with a lender who can walk you through your options. There’s assistance out there waiting for you, and we’re here to guide you through the process, helping you make the dream of home ownership a reality.

If you ever have questions, know that we’re just a call away, ready to help with all your real estate needs!