- calendar_month September 4, 2024

As September unfolds, many of us in the real estate world are keeping a close eye on the Federal Reserve. With inflation easing and the job market cooling, there’s a strong sense that the Fed might soon lower the Federal Funds Rate. Mark Zandi, Chief Economist at Moody’s Analytics, put it simply:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market? And more importantly, what does it mean for you, whether you’re dreaming of buying a new home or thinking about selling your current one?

Why a Rate Cut Matters to You

The Federal Funds Rate is a key player in the world of mortgage rates, alongside factors like the economy and global events. When the Fed lowers this rate, it’s like sending a signal through the broader economy, and mortgage rates often follow suit.

While one rate cut might not drastically reduce mortgage rates, it could help continue the gentle decline we’re already seeing. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), shares:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And if a rate cut is on the horizon, it’s likely just the beginning. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), adds:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

How This Could Affect You

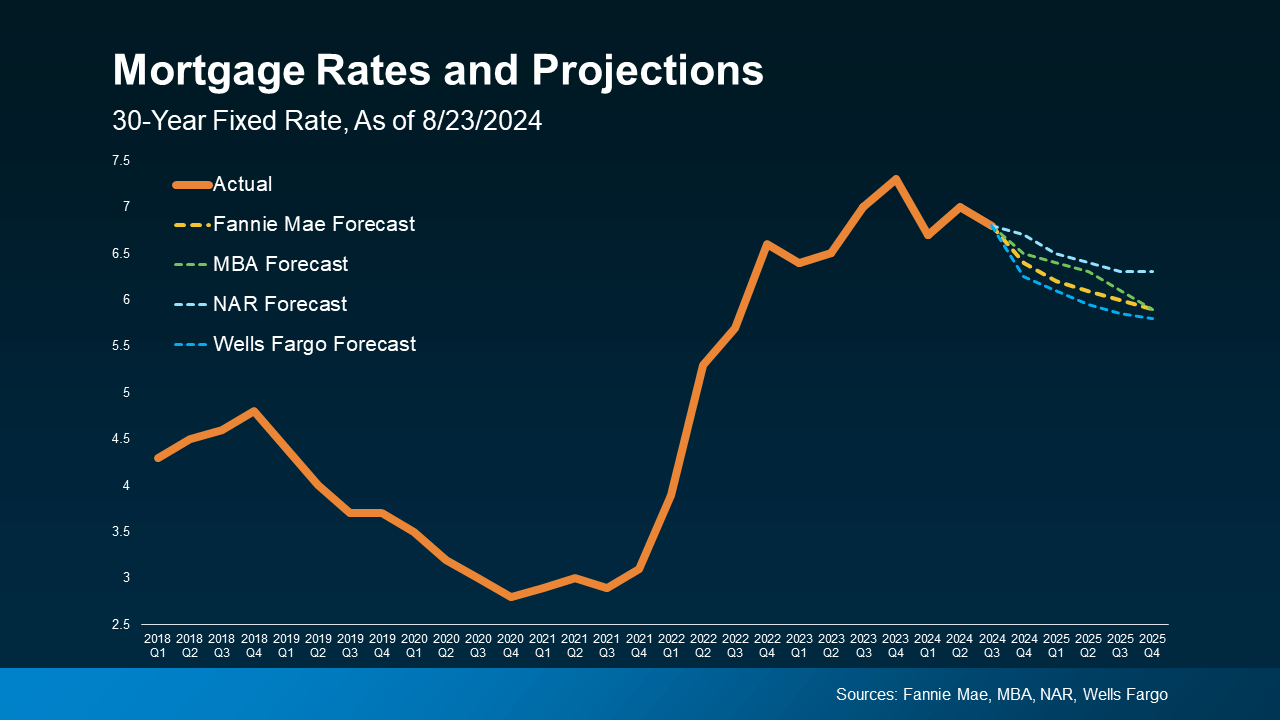

Industry experts foresee mortgage rates continuing to ease through 2025, with help from these anticipated Fed cuts. The graph below highlights the latest projections from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

As inflation improves and the job market cools, a Federal Funds Rate cut could gently lower mortgage rates (as shown in the dotted lines). Here’s why that’s great news for both buyers and sellers:

- It Could Help Ease the Lock-In Effect

If you’re a current homeowner, lower mortgage rates might make it easier to move past the lock-in effect—where you feel anchored to your current home because today’s rates are higher than what you secured when you bought your house.

If the thought of giving up your low-rate mortgage has held you back from selling, a small dip in rates could make the idea of selling a little more appealing. Still, many homeowners may be cautious about giving up their existing mortgage rate, so we’re not expecting a surge of sellers just yet.

- It Could Encourage More Buyers

For those considering buying a home, even a slight drop in mortgage rates can make homeownership more attainable. Lower rates reduce the overall cost, making it a bit easier to take that step toward your dream home.

What Should You Do Next?

While a rate cut might not drastically lower mortgage rates overnight, it’s likely to contribute to the slow and steady decline we’re already witnessing.

And while this anticipated rate cut is a positive sign for the future of the housing market, it’s important to weigh your options today. Jacob Channel, Senior Economist at LendingTree, wisely advises:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Final Thoughts

With a Federal Funds Rate cut likely on the horizon, spurred by easing inflation and a cooling job market, we’re likely to see a gentle, positive shift in mortgage rates. This could open up new opportunities for you. When you’re ready to explore those opportunities, connect with a local real estate agent who can help you navigate the journey ahead.